In short, receipts can relate to more transactions than just those associated with revenues. Another possibility is that the firm sells shares in the business to an investor in exchange for cash. For example, it could receive cash from a lender when it enters into a lending arrangement. Controls are required to safeguard against loss. There are a number of cases in which a company can experience receipts that are not related to revenues. Objectives To establish proper controls and cash handling procedures throughout all University departments. Ten days later, the restaurant pays the bill in full, resulting in a $300 receipt, which is recorded as an increase in cash and a reduction of the account receivable. As soon as the mushrooms are delivered, the food provider can record revenues of $300 and an account receivable in the same amount.

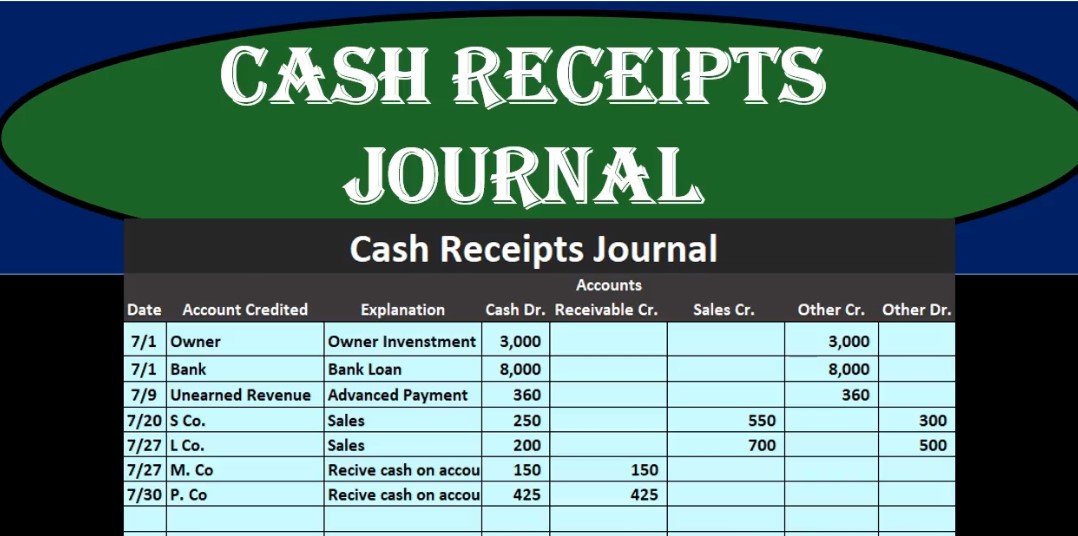

Fonds United Nations Relief and Rehabilitation Administration (UNRRA) (1943-1946). Example of Revenues and ReceiptsĪ food provider sells a crate of mushrooms to a restaurant for $300, under 10-day payment terms. Folder S-1172-0000-0006 - Liquidations Estatements - Cash Receipts. Thus, an additional difference is really just a matter of timing, where the revenue is recorded first, and the receipt is recorded later, when the customer pays. Here is the format of the expanded cash receipts journal. Revenues are earned when goods are sold or services are provided at this point, an invoice is issued to the customer for payment, after which the seller receives payment from the customer (the “receipt”). Record the cash sale in the expanded cash receipts journal: Make all cash receipt entries chronologically in the expanded cash receipts journal. A cash receipt has all the detail(s) of your purchase(s). No person should receive an amount of 2 lakh or more otherwise than in Account payee Cheque, Bank Draft or ECS through a bank account. When you purchase a product, you need a receipt(s) containing the sum amount of payment you had paid towards your purchase.

There have been some important changes in the Income Tax Act regarding cash transactions under section 269ST effective 1st April 2017. Here are the 15 most popular receipt templates: Payment Receipt. The key difference between revenues and receipts is that revenues are reported as sales on the income statement, while receipts increase the cash total on the balance sheet. Restriction on receipt of Cash effective 1st April 2017.

0 kommentar(er)

0 kommentar(er)